Get Complete Project Material File(s) Now! »

Method

This section will provide an explanation for how the purpose of this paper shall be achieved. This includes data col-lection, defining variables and measurements as well as discussing strengths and weaknesses of the chosen methods.

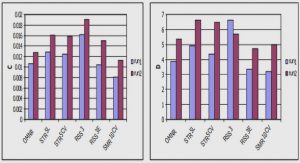

A sample of thirty firms from Stockholm OMXS30 is used as the framework for data collection where each firm’s board structure serves as the background for board diversity testing. Using panel data between 2006 and 2010, firm performance is measured by Tobin’s Q and the inde-pendent variables that measures board diversity are gender, age, education, nationality and board size.

Data Sample

The companies used for this paper are all listed on the OMX Stockholm 30, which are the most frequently traded companies in Sweden (A list of all the firms used in this paper can be found in Appendix A). By including these 30 companies this study represents the entire market and in-cludes firms from different industry sectors, which is important since the different sectors fluctu-ate differently and hence it is possible to avoid industry correlation. The data is collected from Bureau Van Dijk’s database Amadeus and Nasdaq OMX. All data regarding stock prices and ex-change rates were collected from the last day of the respective year.

Since OMXS30 includes Atlas Copco A and B, we choose to treat Atlas Copco as one company for the rest of this paper and used the price of their B stock, which brings down our sample to 29 companies. The sample further decreased during the data collection process. The banks Nordea, Swedbank, SEB and Svenska Handelsbanken were excluded from the sample and reduced the sample to 25 companies. Since the regression presented in Section 4.1 is of panel type, the num-ber of observations is sufficiently large and consists of 25 firms with a time span of five years which equals 125 observations.

Dependent Variable

The Tobin’s Q (TQ) ratio, developed by Tobin, J.J. (1969) measures a firm’s market value in re-spect to its replacement cost of assets and is according to Chung, K. H. & Pruitt, C. W. (1994) a good indicator of the firm’s performance. Interpretations of TQ make it possible to investigate if the firm is over-valuated or not. Another advantage of TQ is that it is forward looking. There is a multitude of different TQ´s that investigates firm values using different formulas consisting of different variables. Most of them focus on the valuation of the stock price to see whether there are any investment possibilities. The original equation of TQ is more focused on the stock mar-ket and how the market evaluates the firms1. Therefore, the Average Tobin’s Q (ATQ) will be used as the measurement of firm performance. This modified version (Equation 3.1) is used due to its ability to measure firm performance in a more direct way, using assets and liabilities rather than the investment possibilities in the firm. The ATQ is a fair estimator when investigating if there are any relation between diversity and firm performance, hence the ATQ will be used in this study. Equation 3.1 as presented by Chung & Pruitt (1994) is as follows:

where the variable MUE is the share price times the amount of shares outstanding, RS is the liq-uidating value of the outstanding preferred stocks, DEBT equals the firms short-term liabilities minus its short term assets plus long term debt and TA stands for the total assets of the firm.

This definition of TQ is not the only way to construct the equation. There are several different methods to calculate the ratio. Many of the other Tobin’s Q versions are more precise and have some variables included that cannot be found neither in databases nor in the firm’s annual re-ports. This is also true for Mueller, D.C. & Reardon, E. (1993); their marginal TQ is complicated due to the multitude of factors included in the model. However, ATQ is similar to the other TQ´s and the results are practically the same, it is also more in line with the research question be-cause ATQ shows the firm value in a more direct way. Hence, for this paper the ATQ is validat-ed to use (Lindenberg, B.E. & Ross, A.S. 1981).

When interpreting Tobin’s Q values, an overvalued firm will have a TQ value that is higher than 1 and a firm that has a value between 0 and 1 will be accurately valued. If a firm has Q>1 it shows that there are other factors that influence the perceived value of the firm, these influences cannot be detected in the annual report (Chung & Pruitt, 1994)

The variable RS, representing the liquidating value of preferred stock, is equal to zero for all ATQ ratio calculations because none of the firms used for this research actually have preferred stocks. The only company on the OMXS30 with preferred stocks is Swedbank, which was ex-cluded from this research for other reasons.

The data for calculating the ATQ variable was collected through Bureau Van Dijk’s database Amadeus and the Nasdaq OMX database of historical stock prices. If the databases where lack-ing information we turned directly to the annual reports of the affected firms. The data regarding numbers from the firms’ balance sheets was exclusively presented in Euro and since the stock prices were presented in SEK we had to convert those into Euro using historical exchange rates

Some previous research presented in Section 1.2, uses other performance measures than Tobin’s Q. Erhardt et al. (2003) use return on assets and investment, while Adler (2001) uses revenues, assets and stock equity to measure firm performance. This paper uses Tobin’s Q because it in-cludes more factors than the other measurements and these factors cannot only be found in the balance sheet of the firm but also in their stock prices, which overall gives a better indication of the performance than the other measurements.

Adjusted Stock Prices in ATQ

When calculating ATQ for the chosen companies, some values were unexpected and suspiciously high. To correct for this we decided to calculate the variables using adjusted stock prices instead of absolute prices, these adjusted prices takes into account if the company has issued a stock split during the chosen time period and thus gives a more accurate number. After including the adjust-ed stock prices the ATQ became more reasonable for the affected firms and therefore these val-ues for ATQ are used in the regression of this paper. One should note that in most cases there are no differences between absolute and adjusted stock prices. The original ATQ and the adjust-ed ATQ (AATQ) values can be seen in Appendix A.

Independent Variables

Gender

In the model, the gender variable is the percentage of female members within the board. We use the percentage of female instead of men because previous research and our own projections di-rects to the fact that the present state of boards today is a higher percentage of male members than female members, hence an increase of the percentage of female board members equals a more diversified board. To get the percentage of female board members, the number of female members is divided over the total number of board members.

Age

Regarding the age variable, theory suggests diversity to increase with board members of different age and large range between the ages of the members. Hence, to be able to include this variable one needs to find a measurement that accounts for age differentials within the board. This is done by calculating the variance of the different ages within the boards and thereafter calculating the standard deviation. By doing this, the age variable represented by the standard deviation, now indicates the level of age diversity. The higher the variance, the more the variable deviates from its mean and hence the more age diversity within the board.

Education

Previous research suggests that members with education promote the diversity within the board. To include this independent variable we use the percentage of board members with an education and divide the numbers of persons with education over total number of board members. To dis-tinguish between having an education or not, we use the board members that have a university degree or not. This paper does not consider the degree itself or higher degrees within university level. For a member of the board to account within the group of having a university degree, they have to hold at least a bachelor degree or a corresponding level of education. The limitations to these preferences are the availability of data and our own interpretation regarding which degrees to account for, nevertheless we have been consistent throughout the research.

Nationality

Previous research presented in this paper suggests that the level of diversity increases with a board that includes individuals with different nationalities. This variable is included in our model by calculating the percentage of different nationalities within the board, a higher number of this variable indicates a more diversified board. During the data collection process there were some cases where the company did not provide information of the nationality of the board members in their annual reports, however in those cases we used other databases or sources to identify the place of birth of the person(s) in question. There are however some limitations to this variable. By using the nationality or birth place of an individual, we do not account for if he or her has lived longer periods in other countries which most certainly affects the personality of that person and hence the overall diversity of the board.

Board Size

Board size is considered to play an important part in determining the board diversity. Theory suggests that with more members the possibility of having a diversified board increases. Howev-er, it is important to note that some theory suggest that there is a hidden cost when increasing board size, namely communication problems. In our regression, we treat the number of board members as an absolute value.

Model Specification

The model of this paper is a panel data regression model, which means that the same cross-sectional units are observed over time. In the case of our regression, data for each single firm is collected for the years 2006 -2010. By doing so, we get more observations (125) than if only cross section data would be used (25) . There are however other advantages with panel data, the panel data is generally said to be more informative, more efficient and have less collinearity among variables than ordinary cross section data. Furthermore, by using many cross sections observations the panel data are preferable when study dynamic changes, which is suitable for this paper (Guja-rati, D. N. & Porter, D.C., 2009).

The dependent variable and the independent variables are described thoroughly above; this sub section will present the structure of how the model is built. The model is based on Equation 3.2:

i= 1, 2, 3,…,25

t= 1, 2, 3, 4, 5.

The variables and subscripts for the model are explained in Table 3.1.

Since our data is of panel type and consists of observations from different years, one should preferably remove effects that occur over time, such as inflation, deflation, extreme stock market fluctuations and so forth. This can statistically be done by using effect specification and therefore treat the periods as fixed and as dummy variables. These dummy variables will effectively remove some of the previously mentioned external effects of having data from different time periods, which gives Equation 3.3 (Gujarati & Porter, 2009; Angrist, J. D. & Pischke, J., 2009).

i= 1, 2, 3,…,25

t= 1, 2, 3, 4, 5.

The variables and subscripts for the model are explained in Table 3.1.

Hypotheses

In this subsection, the different hypotheses of this paper will be presented and later discussed in the Empirical Findings and Analysis sections. To enable further analysis of the individual varia-bles, each variable is given its own hypothesis and hence it will be possible to see both the overall and individual impacts on firm performance. The overall null hypothesis is that board diversity has no impact on firm performance. Thus, if that hypothesis is rejected there is some relationship between board diversity and firm performance at different statistical significance levels.

The age variable is expected to relate to firm performance and thus the null hypothesis is that there is no relationship between the independent age variable and the dependent variable. The education variable is expected to have an impact on firm performance and hence the null hy-pothesis is that there is no relationship between the independent age variable and firm perfor-mance. Gender diversity is expected to be related to firm performance; hence, the null hypothesis is that there is no relationship between gender diversity and firm performance. Regarding the in-dependent variable board size, it is predicted that it has a relationship with firm performance, for this reason the null hypothesis is that there is no relationship between board size and firm per-formance. The null hypothesis regarding the variable representing nationalities is that there is no relationship between nationality diversity and firm performance, hence if it is rejected there is a relationship between the two.

Expected Relationships

The different hypotheses presented in Section 3.5, describes whether the respective variables af-fect the dependent variable representing firm performance, in either positive or negative way. However, it is also interesting to analyze whether the relationship is positive or negative for those hypotheses that can be rejected. Hence, if the results show that, for example, the hypothesis re-garding age can be rejected, it is interesting to further see if the age variable is positively or nega-tively related to firm performance. Table 3-2, presents our expectations that are based upon pre-vious studies and theoretical framework. Moreover, the previous studies and theoretical frame-work are in many cases somewhat ambiguous, where some research presents positive results whilst other presents negative ones. However, the expectations presented in Table 3-2 are the ones most justified and most commonly presented

Note that the board size variable is the only variable that is expected to have a negative relation-ship towards firm performance. Research and theoretical framework suggest that it can be posi-tive related because it increases heterogeneity and thus increase diversity. However, research also suggests that communication problems occurs in large boards, this can be further explained by Equation 2.1 in subsection 2.4 and therefore the expected relationship is negative.

Table of Contents

1 Introduction

1.1 Background

1.2 Previous Research

1.3 Problem

1.4 Purpose

2 Theoretical Framework

2.1 Corporate Governance

2.2 Boards

2.3 Homogeneity and Heterogeneity

2.4 Transaction Cost

2.5 Learning Curve Theory

2.6 Board Diversity

2.7 Firm Specific Factors

3 Method

3.1 Data Sample

3.2 Dependent Variable

3.3 Independent Variables

3.4 Model Specification

3.5 Hypotheses

3.6 Expected Relationships

4 Empirical Findings

4.1 Regression

5 Analysis

6 Conclusion

List of references

GET THE COMPLETE PROJECT

The Importance of Board Diversity Measured by Tobin’s Q