Get Complete Project Material File(s) Now! »

Heterogeneous Firms, Financial Networks, and Aggregate Fluctuations

Introduction

The financial sector can be an engine of growth but also amplify shocks and cause long-lasting recessions. This has been painfully demonstrated by the global financial crisis. Financial institu-tions play this central role because they are strongly involved in many stages of firms’ production processes. Indeed, many firms rely on external financing sources to cover their capital expenditure. This not only makes firms dependent on financial institutions but also exposes financial institutions to credit risks. For example, a firm-level productivity shock to a car producer not only affects sup-pliers but also the risk exposure of its lenders and might even pose a threat to financial stability.1 If the affected financial institution is broadly invested in different sectors of the economy, a produc-tivity shock to one firm in its portfolio can even affect firms that are distant or seemingly unrelated in terms of their input-output relationship. Two questions are addressed in this paper: First, how does this financial multiplier of productivity shocks depend on structural parameters, the shape of the financial network, and the position of the firm in the input-output network? Second, how important is the financial multiplier empirically for an economy’s aggregate output?

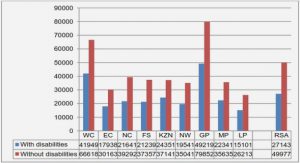

Answering these questions requires detailed data on banks’ exposures to individual firms. Fig-ure 2.1 presents such data for the case of France. It shows that corporate bond holdings of 155 French banks and their bilateral exposures in terms of equity shares and debt securities are highly concentrated. Only a subset of banks invest in corporate bonds, and only a subset of sectors issue significant amounts. Among the sectors that receive most bond financing through banks are elec-tricity, gas, steam and air conditioning supply (3), telecommunications (5), legal and accounting services, head offices (7), and warehousing and support activities for transportation (8). For ex-ample, a shock to a telecommunications firm could affect warehousing firms through their indirect financial connections. Since firms and banks respond endogenously to productivity shocks, an-swering the questions of this paper also requires to specify the optimal behavior of heterogeneous firms on product markets and financial markets as well as banks’ balance-sheet management. The empirical identification of the financial multiplier requires to allow for shock propagation through the input-output production network (see Acemoglu et al. (2012)) to separately identify additional propagation through the financial markets.

In this paper, I build a multi-sector model of heterogeneous firms augmented with heteroge-neous leverage targeting banks to study the financial multiplier propagation channel of productiv-ity shocks. To the best of my knowledge, this is the first paper to integrate input-output linkages between firms with a financial network between heterogeneous banks. Data requirements may ex-plain this gap. I use confidential data from the Banque de France from regulatory filings on a large number of firms, a large number of banks, and their linkages to estimate firm-level productivity shocks and the structural parameters of the model. Financial equilibrium prices are obtained nu-merically by applying Brouwer’s fixed point theorem for over 1, 400 financial assets that are traded between firms and banks and serve as a propagation vector of productivity shocks. I find that the financial network multiplier is empirically relevant. Depending on the banks’ costs of deviating from a bank-specific leverage target, it captures positive or possibly negative spillovers to other firms in the economy.

This figure shows the French sectoral input-output production network (left), banks’ cross-holdings of debt and equity securities (right), and linkages between banks and firms through corporate debt markets in 2011.

Note: Orange nodes correspond to 50 real sectors (ISIC-2 classification) which are connected through input-output production relations. Blue nodes correspond to French banks which are connected through equity and debt securities cross-holdings. Banks’ investments into corporate debt securities are symbolized by black arrows. For confidentiality reasons, banks are aggregated into groups of three in consecutive sizes. Data sources: PROTIDE, M-SITMENS, and FIBEN.

In the model, firms are connected to the financial sector because they face a cash-in-advance constraint to finance capital expenditure (see Rajan & Zingales (1998)). This external financ-ing constraint is a crucial ingredient for the mechanism of the model as it requires firms to issue costly debt before production. Thus, firms’ marginal costs depend on the costs of funds, which are determined in the financial market equilibrium. Since firms within a sector produce differen-tiated varieties and face downward-sloping demand, firms pass on their financing costs to product prices which ultimately affects aggregate output. Firms are linked to banks because banks invest in corporate debt and re-balance their portfolio in response to productivity shocks. This is the key mechanism of the paper. Indeed, banks are assumed to target a given leverage ratio (following Greenwood et al. (2015)). However, since deviations from target leverage are costly (see Zhou, Tan, Faff & Zhu (2016)), banks face a trade-off between maximizing their value of equity and keeping leverage close to target. In response to a change in their asset value, banks may therefore either increase or decrease their balance-sheet size. If banks are allowed to let their leverage fluctu-ate sufficiently, productivity shocks tend to generate positive spillovers (see Banerjee & Feinstein (2019))

I shows that one statistics is sufficient to capture the effect of firms’ productivity shocks on aggregate output akin to the influence measure proposed by Acemoglu et al. (2012). In contrast to pure production networks, influence in my model features an additional term. I call this term the financial network multiplier of productivity shocks. It captures the total impact of changes in the financial market equilibrium induced by a firm-level productivity shock. As a financial counterpart to the Leontieff inverse in production networks, a key role in this term is played by the price-impact or co-liquidity matrix of trade (see also Heipertz, Ouazad & Rancière (2019), Koijen & Yogo (2019)). This matrix captures the general equilibrium response of asset prices and is given by the inverse of the semi-elasticity of excess market demand with respect prices. It, in turn, depends on the structural parameters of banks’ balance-sheet management and firms’ debt supply.

Related Literature: The paper is related to the literature on the micro-origins of aggregate fluctuations. This literature studies the conditions under which micro-economic shocks show-up in macroeconomic aggregates. In particular, the granular origins hypothesis emphasizes that if firms’ size distribution is fat-tailed, idiosyncratic shocks to large firms do not wash-out, but may lead to aggregate fluctuations (Gabaix 2011). Following the granular origins hypothesis, a theoretical and empirical literature shows how aggregate fluctuations can also arise from micro-economic shocks due to input-output production relations (Acemoglu et al. 2012, di Giovanni, Levchenko & Mejean 2014, Grassi & Carvalho 2019, Grassi 2018). My paper shares with this literature the aim to explain aggregate fluctuations by micro-economic shocks, however, it departs from it by shifting the focus to the contribution of the financial network to the propagation of shocks. In this literature, the paper most closely related is Bigio & La’O (2019) who build on Acemoglu et al. (2012) (for example, allowing for decreasing returns to scale) and introduce exogenous sector-level frictions. They show how sectoral distortions including exogenous financial frictions propagate through the production network. Different to them, the financial friction in my paper, however, depends on financial asset prices that are determined endogeneously in the financial market equilibrium. As such, the financial friction in my paper introduces an additional, new channel for the propagation of shocks.

The paper also relates to the literature on the real effects of bank lending that uses matched firm-bank data. In common with this literature, I analyze the role of banks for the real economy. In contrast to this literature, however, I focus on shocks originating in the real economy. Jiménez, Mian, Peydró & Saurina (2019) uses the Spanish matched credit register to study the effect of credit booms on firms’ production and allow for general equilibrium adjustments. Two other examples using matched firm-bank data are Amiti & Weinstein (2018) and Alfaro, Garcia-Santana & Moral-Benito (2018). They measure the importance of banks’ credit supply for investment, output, and employment.

Structure of the paper: In Section 2.2 I present the model and solve for the equilibrium and Section 2.3 derives the main theoretical result of the paper, the financial network multiplier. In Section 2.4, I present the data and explain the empirical strategy and present estimated structural parameters and firm-level productivity shocks. Section 2.5 presents the main empirical results, the estimated financial network multiplier using French data. Section 2.6 concludes.

The Model

This section describes the structure of the economy. There are three types of agents. First, a representative household consumes and supplies labor to firms. Second, firms belong to different sectors, hire labor, and source inputs for production from other firms in the economy. Input-output relationships between firms constitute a production network. Firms also have to finance a fixed share of their capital expenditure by debt. Third, banks provide funds to firms by investing into firms’ debt. Banks also issue liabilities that can be bought by other banks. Bilateral exposures between banks constitute a financial network.

In each period, firms are subject to idiosyncratic total factor productivity shocks. Since the model is static, I drop the time index in the following.

Household

The representative household has preferences U (C, L) over a composite consumption good C and hours worked L. The composite consumption good is a Cobb-Douglas aggregation of N sector goods C = η ∏Ns=1 Csγs , where Ck is the amount of good k consumed by the household and η is a normalization constant. γk is the share of good k in the household’s consumption expenditure. The price of good k and the price index of the composite consumption good are Pk and P = ∏Ns=1 Psγs , respectively.

Each good k further is made of a number Nk of varieties. Varieties are aggregated with a εk−1 εk constant elasticity of substitution εk, such that Ck = ∑Nf=k εk−1 and the household 1 C(k, f ) εk consumes the amount C(k, i) of sector k’s variety i. The price of good k is an index of variety prices and satisfies Pk = ∑Nf=k1 P(k, f )1−εk 1−εk .

The household receives a wage h for working as well as profits for owning firms.

Firms

Firms of the same sector use the same production technology to produce their varieties. Since firms face downward-sloping demand, they have market power and set prices. Firms are heterogeneous in total factor productivity and external financing needs. There are Nk firms in sector k and N sectors in the economy.

Production Technology: A firm i of sector k uses labor L(k, i), intermediate inputs X (k, i), and capital K(k, i) to produce Y (k, i) units of its variety with Cobb-Douglas production function, Y (k, i) = ηkZ(k, i)X (k, i)αk K(k, i)βk L(k, i)1−αk−βk , (2.1) where Z(k, i) is the stochastic level of total factor productivity and ηk is a normalization con-stant. The share of intermediate inputs and capital are denoted αk and βk, respectively.

Firms of sector k require a share wXkl of sector l’s goods as intermediate input. That is X (k, i) = ∏Ns=1 X (k, i, s)wXks is an aggregation of sector goods and X (k, i, l) is a composite of sector l’s vari-eties. Similarly, also capital is a composite of sector goods, K(k, i) = ∏Ns=1 K(k, i, s)wKks , where wKkl is the share of sector l’s good in sector k’s capital good. Price indices of sector k’s intermediate inputs and capital satisfy PX = ∏N PwksX and PK = ∏N PwksK , respectively. Further, firms can k s=1 k k s=1 k substitute between sector l’s varieties with the same elasticity of substitution εk as households.

X (k, i, l, f ) and K(k, i, l, f ) denote the amounts of sector l’s variety f used as intermediate input and capital, respectively, in the production of variety i of sector k.

There is no fundamental difference between the role of intermediate inputs and capital in the firm’s production technology: Both inputs are chosen at the same point in time and enter current period’s production. I distinguish between the two, however, because their financing differs as becomes clear following.

Input Financing: Firms need to finance a part of their capital expenditure externally. As argued by Rajan & Zingales (1998) external financing needs depend on factors such as industry or age. For example, drugs and pharmaceutical firms typically need more outside funds than firms in the textile industry. To capture this heterogeneity, I assume that firm i of sector k needs sufficient cash-in-advance to finance an exogenous share S(k, i) ∈ [0, 1) of its capital expenditure.

To acquire cash, firms access financial markets before production. At the beginning of the period, firm i of sector k issues a number B(k, i) of debt contracts at price Q(k, i). The proceeds from bond issuance are held in the form of deposits D(k, i) which cost Q. At the end of the period, production takes place both, debt contracts and deposits, pay off 1 unit of currency. The cash in advance constraint requires that the payoff from deposit holdings covers an exogenous fraction of capital expenditure, D(k, i) ≥ S(k, i)PK K(k, i). Remaining capital expenditure is financed by internal operating cash flows. Intermediate input expenditure PX X (k, i) and the wage-bill hL(k, i), on the other hand, are fully financed by the firm’s operating cash flows. Figure 2.2 summarizes the inter-period timing of the firm’s decisions and cash flows.

Firms’ marginal costs not only depend on the wage and other sectors’ prices (due to input-output production relationships), but also on the price of debt (due to the debt-financing of capital expenditures).

Lemma 2.1. Capital Surcharge. Firm i of sector k incurs costs Λ(k, i) to produce the marginal unit of its variety: −1 N αkwksX+βkwksK 1−αk−βk

Λ(k, i) ≡ Z(k, i) χ (k, i) ∏ Ps (2.2)

where χ (k, i) ≡ 1 − S(k, i) 1 − QD βk ≥ 1.2 Thus, debt financing introduces a surcharge on Q(k,i) capital expenses into marginal costs.3 Profit maximization under Dixit and Stiglitz (1977) monop- olistic competition implies a constant mark-up pricing rule P(k, i) = MkΛ(k, i), where Mk ≡ ε k . εk−1 Sector k’s good price is Pk = MkΛk, where Λk ≡ ∑Nf=k 1 Λ(k, i)1−εk 1−εk are sector k’s marginal costs.

Proof. See Appendix A.2.1.

Lemma 2.1 shows that debt financing introduces a capital surcharge. The more a firm relies on debt to finance capital expenditure S(k, i) → 1, the larger the additional expense χ (k, i) → QD/Q(k, i). Vice versa, the surcharge disappears χ (k, i) → 1, if S(k, i) → 0. Furthermore, the larger the share βk of capital in production, the larger the influence of debt prices on marginal costs. Marginal costs decrease if the price of debt increases, and vice versa.

Monopolistic Competition: Firm i of sector k faces downward-sloping demand Y (k, i) = (P(k, i)/Pk)−εk Yk for its variety, where Yk is sector k’s gross output. Downward-sloping demand endows firms with monopolistic power and variety prices in sector k are set at a mark-up Mk over marginal costs. The more substitutable sector k’s varieties are (the higher εk), the lower is the mark-up.

Since a firm’s debt price enters marginal costs, it also affects its variety price, and eventually the sector good price, Pk (see Lemma 2.1). The sector good price, in turn, affects demand for other firms of sector k. For example, an increase of the bond price of Peugot (e.g. due to the ECB’s corporate bond purchase program) would decrease Peugot’s marginal costs. With constant mark-up pricing Peugot’s cars become cheaper, while the relative price of Renault’s cars increases. Q(k,i)R −1 PX αk χ (k, i)1/βk PK βk h1−αk −βk where 3Indeed, marginal costs can be rewritten as Λ(k, i) = Z(k, i) χ (k, i)1/βk PK is the contribution of capital expenses to the cost of producing the marginal unit of output.

Debt prices change relative variety prices and lead to demand re-balancing within the same sector. Ceteris paribus, Peugot produces more and Renault produces less. This example also illustrates that changes in debt prices can even affect firms that do not issue any debt.4

Lemma 2.2 formalizes how firms’ sales depend on debt prices due to monopolistic competition.

Lemma 2.2. Within-Sector Sales Distribution. Firm (k, i)’s sales are a share of sector k’s aggre-gate sales,

P(k, i)Y (k, i) = ζ (k, i) PkYk, (2.3)

Z(k,i) χ (k,i) εk−1

with ζ (k, i) ≡ ∈ (0, 1), Zk sector k’s productivity, and χk its capital surcharge

Zk χk

(defined as the productivity-weighted power mean of firms’ capital surchages). The within-sector sales distribution is determined by relative (i) productivity, and (ii) financing costs.

Proof. See Appendix A.2.2.

Debt Supply: To produce gross output P(k, i)Y (k, i), firm i of sector k demand inputs such that it spends constant fractions αk, βk, and 1 − αk − βk of total expenditure on intermediate in-puts, capital, and labor. Under Cobb-Dougals technology total expenditure is given by the product Λ(k, i)Y (k, i), because marginal costs equal average costs. Due to monopolistic competition, to-tal expenditure is a constant fraction of sales Mk−1P(k, i)Y (k, i). Since total sales are determined by the firms’ productivity and debt prices (see Lemma 2.2), so is total expenditure and input de-mand. Finally, external financing needs imply that the supply of debt contracts depends on firms’ productivity and debt prices.

Lemma 2.3. Firms’ Debt Supply. From (k, i)’s balance-sheet identity at the beginning of the period and financing constraint, debt supply is B(k, i) = βk • QD S(k, i)χ (k, i)−1/βk Mk−1ζ (k, i)PkYk. (2.4) Q(k, i)

Deposit demand is D(k, i) = B(k, i) • Q(k, i)/Qd . Both functions are homogeneous of degree zero in financial asset prices.

Proof. See Appendix A.2.3.

Before characterizing the equilibrium in variety and labor markets in Section 2.2.4, I describe next how banks allocate their resources between the financial assets in this economy.

Banks

There are NB banks which are indexed by b. Each bank finances its portfolio by an exogenous number E(b) of shares, an exogenous number of deposits D(b), and by issuing B(b) debt contracts. Banks choose their balance-sheet at the beginning of the period. As in Greenwood et al. (2015) and consistent with empirical evidence provided for example by Adrian & Shin (2010) banks target a given leverage ratio and adjust their balance-sheet size to achieve it.

Banks are heterogeneous in their equity endowments, their leverage target τ ∗(b), and their portfolio allocation.

Banks’ Balance-Sheet Diversification: With equity, debt and deposit prices noted QE (b), QB(b), and QD, respectively, bank b’s total value is A(b) ≡ QE (b)E(b)+QDD(b) + QB(b)B(b). Bank b invests into a rich set of financial assets: First, bank b holds E(b, d) units of other bank d’s equity and B(b, d) of debt. Deposits are homogeneous across banks, such that D(b) denotes the units of a generic deposit held by banks b.5 Such cross-holdings of banks’ liabilities constitute the financial network. Second, banks invest into debt contracts issued by firms B(b, k, i). These invest-ments constitute the link between firms and banks. Third, bank b also invests into an outside asset O(b, r) which is issued by the rest of the world r at price QO. Similar to Koijen & Yogo (2019), the outside asset captures items on banks’ balance-sheets that are not part of before-mentioned assets (here for example: loans, government debt, or investments abroad). Figure 2.3 illustrates bank b’s balance-sheet.

How do banks allocate their portfolio across financial assets? Following a seminal literature on financial networks (e.g. Eisenberg & Noe (2001b), Elliott et al. (2014)) I take banks’ portfolio allocation as given.6 It is summarized by the NB × 3NB + ∑Ns=1 Ns + 1 -size matrix Ω, whose bth row, ω ′(b), contains the shares of bank b’s portfolio invested into financial assets. Financial assets are ordered as in Figure 2.3, such that the first 3NB columns contain banks’ equity, debt, and deposits.

Endogenous Balance-Sheet Size: Each bank b is also characterized by an exogenous lever-age target τ ∗(b). Leverage is defined as the value of debt and deposits over the value of equity, τ (b) ≡ QDD(b) + QB(b)B(b) QE (b)E(b). If the value of banks’ assets increase, actual lever-age decreases because the value of equity increases ceteris paribus. To restore leverage to target, banks issue liabilities, buy assets, and scale up their balance-sheet. Vice versa, if the value of banks’ assets decreases, equity value decreases, and leverage goes up. In this case, the bank sells assets, pays back debt, and scales down its balances-sheet. I assume that banks pay a quadratic costs for deviating from their leverage target 12 c(b)(τ (b) − τ ∗(b)).7 Since the equity value at the end of the period increases with the balance-sheet size, banks face a trade-off between maximizing equity value and keeping leverage at target. The bank chooses its balance-sheet size and its debt issuance in order to optimize this trade-off.

Lemma 2.4. Leverage Targeting. Under leverage targeting bank b supplies debt such that τ (b) − τ ∗(b) = 1 diag Q−1ω (b) − 1 QE . (2.5) c(b) QB

Leverage Deviation Return on Equity

If the cost of deviating from target goes to infinity c(b) → ∞, the bank ensures τ (b) = τ ∗(b). Bond supply is homogeneous of degree zero in prices. Asset demand follows from the balance-sheet identity as A(b) • diag Q−1 • ω (b).

Proof. See Appendix A.2.4.

Banks’ endogenous balance-sheet size implies that cross-price demand elasticities can be posi-tive (in contrast to standard demand systems). To understand this, imagine that deviation costs are very high and that the corporate debt price Q(k, i) increases. First, the fall in the price increases the bank’s return on equity (see Lemma 2.4). The bank has an incentive to issue more debt and invest more into its portfolio (the standard negative substitution effect applies). Second, however, the decrease of the corporate debt price also increases leverage because the value of today’s assets decreases. If the cost of deviating from target leverage is very high, the bank has to scale down its balance-sheet. It pays back debt and sells assets (fire sales). As a result, demand for all financial assets decreases in proportion of their portfolio weight.

Equilibrium

There are three types of markets in the economy, markets for varieties, labor, and financial assets. In this section, I first show that aggregate output and firms’ sales can be solved analytically as a function of financial asset prices. In the second step, the financial markets equilibrium is obtained numerically.

Proposition 2.1. Aggregate Output. For given financial asset prices and normalized labor supply L = 1, variety and labor market clearings imply logY = ηY + γk′ (I − W )−1 (log Zk − log χk) , (2.6) where the production network is W ≡ diag(αk)W X − diag(βk)W K diag(Mk)−1 and ηY is a con-stant. The k-size vectors Zk and χk collect sectoral productivity and capital surcharges, respec-tively. With a normalized final good price P = 1, sectoral sales are PkYk = (I − W ′)−1γk • ηPY Y , where ηPY is a constant. Firm (k, i)’s sales and bond supply follow from Equation 2.6 and Lem-mas 2.2 and 2.3.

Proof. See Appendix A.2.5.

Proposition 2.1 shows how productivity shocks propagate through the production network in partial equilibrium (fixed financial asset prices). The propagation of both (i) productivity shock and (ii) capital surcharges is determined by the Leontieff inverse (I − W )−1 which captures all direct and indirect consumption of sectoral goods. Note that the case of no external financing needs is nested in the Equation 2.6: If S(k, i) = 0 ∀k, i, χk = 1 and aggregate output is determined by productivity shocks alone. With external financing needs, aggregate output is also affected by financial asset prices through firms’ capital surcharges.8

In general equilibrium financial asset prices adjust. Following a positive productivity shock, firm (k, i)’s reduces its variety price (due to the constant market-up rule). It produces more because demand is elastic, demands more inputs, and issues additional debt to meet external financing needs. Thus, the productivity shock generates excess supply of firm (k, i)’s debt. It also generates excess demand for debt of other sector k firms who produce less and shrink their debt supply (Lemma 2.2). To clear partial disequilibria in the debt markets, the price of firm (k, i)’s debt has to decrease and the debt price of other sector k firms increases. In response to changes in debt prices, however, banks’ asset return and leverage changes. Banks adjust their balance-sheet size to reoptimize their trade-off between return and leverage target. Resulting changes in banks’ demand for and supply leads to new partial disequilibria in financial markets and to subsequent rounds of banks’ balance-sheet size adjustments. Therefore, the initial shock to (k, i)’s productivity may propagate through financial markets even to firms that are very distant in terms of their input-output relations.

Rest of the World: To capture trade in financial assets with other agents of the economy, for example insurances, funds, or foreign entities, I introduce a catch-all rest of the world sector. Indeed, this is important in the empirical part of the paper in order to close the system of balance-sheets and clear financial markets. Rest of world’s asset demand and supply is obtained as the residual necessary to clear markets and is assumed to be exogenous. While this assumption is strong, the analysis does not change if the rest of the world would be further dis-aggregated or would also seek to optimize its balance-sheet. In this case, the propagation of firms’ productivity shocks through financial markets would likely be amplified. The reason is that productivity shock would spread to a larger number of financial markets. Nonetheless, I believe that the empirical results obtained in Section 2.4 provide a useful benchmark for the extent to which banks’ leverage targeting contributes to the propagation of firms’ productivity shocks.

Table of contents :

1 Introduction

2 Firms, Financial Networks, Aggregate Fluctuations

2.1 Introduction

2.2 The Model

2.2.1 Household

2.2.2 Firms

2.2.3 Banks

2.2.4 Equilibrium

2.3 The Financial Network Multiplier

2.4 Estimation

2.4.1 Data

2.4.1.1 Firms

2.4.1.2 Banks

2.4.2 Empirical Strategy

2.4.2.1 Substitution and Factor Elasticities

2.4.2.2 Productivity Shocks

2.4.2.3 Banks’ Structural Parameters

2.5 Equilibrium Results

2.5.1 Financial Spill-Overs

2.5.2 Importance of the Financial Network

2.5.3 Which firms are most influential?

2.6 Conclusion

3 Endogenous Financial Networks

3.1 Introduction

3.2 The Financial Network

3.2.1 Balance-Sheet Diversification and Size

3.2.2 Market Equilibrium with Trade Costs

3.2.3 Shock Propagation Through the Financial Network

3.2.4 Network Structure: Amplification or Mitigation

3.2.5 Measuring the Systemicness of Institutions

3.3 Structural Estimation

3.3.1 Parameterization: Demand, Trade Costs, Beliefs

3.3.2 Model Identification: Intuitions

3.3.3 From Return Beliefs to Net-Demands: A Dynamic Factor Model

3.3.4 From Net-Demands to Return Beliefs: Identification

3.3.5 Estimation Procedure

3.4 Data

3.5 Structural Parameters

3.5.1 Return Beliefs

3.5.2 Risk-aversion

3.5.3 Trade costs

3.6 The Network in General Equilibrium

3.6.1 Network Structure

3.6.2 Structural Policy Evaluation: the case of ECB Quantitative Easing

3.7 Conclusion

4 Domestic and External Sectoral Portfolios

4.1 Introduction

4.2 Data Description

4.3 Domestic and External Sectoral Portfolios

4.3.1 Constructing Sectoral Portfolios

4.3.2 Stylized Facts on French Domestic and External Sectoral Portfolios

4.3.2.1 External Portfolios

4.3.2.2 External Cross Sectoral Portfolios

4.3.2.3 Domestic versus Foreign Portfolios

4.3.3 The Network Structure of Domestic and External Portfolios

4.4 An Estimated Model of Sectoral Balance-Sheet Contagion

4.4.1 The Model

4.4.1.1 Asset Demand and Supply

4.4.1.2 Sectoral Balance-Sheet Equilibrium

4.4.1.3 Balance-Sheet Contagion

4.4.2 Identification and Estimation

4.4.2.1 Moment Conditions

4.4.2.2 Two-Step GMM

4.4.3 Results

4.5 Conclusion

Bibliography

A Appendix of Chapter 2

A.1 Figures and Tables

A.2 Proofs

A.2.1 Lemma 2.1: Firms’ Marginal Costs

A.2.2 Lemma 2.2: Within-Sector Sales Distribution

A.2.3 Lemma 2.3: Firms’ Debt Supply

A.2.4 Lemma 2.4: Leverage Targeting

A.2.5 Proposition 2.1: Aggregate Output

A.2.6 Proposition 2.3: Financial Multiplier

B Appendix of Chapter 3

B.1 Figures & Tables

B.2 Theory

B.2.1 Proofs: General Equilibrium Model

B.2.2 Proofs of Identification

B.3 Data

B.3.1 Estimation of Returns

B.3.2 Imputation of the Real Asset

C Appendix of Chapter 4

C.1 Figures

C.2 Tables