Get Complete Project Material File(s) Now! »

New kinds of available data

Insurers were historically relying on data to assess global or individual risks, such as aggregate data on the population as a whole, individual age or place of living. This type of information represents what is called traditional datasets. It has been used to create risk classes by grouping individuals with apparently similar “objec-tive” characteristics in more or less homogeneous groups and assign the same pure premium level to the entire class.

One of the characteristics of those traditional datasets is that the information that constitutes them is declarative and provided by policyholders through surveys during the underwriting stage when the contract is signed. The International Asso-ciation of Insurance Supervisors (IAIS) qualifies this type of information as direct (IAIS, 2020).

Since the fast development of technologies, new types of data from new sources have become available to insurers. Hence, in some cases, it has a different qual-ity than the traditional data. It can be indirect data, such as data from smart-phones, other connected mobile devices, sensors, Global Positioning System (GPS) and satellite-based systems. Overall, both traditional and non-traditional datasets are increasingly available due to technological innovations, allowing easier access to data and creating new sources of information. In particular, new types of data are combined with traditional data, as stated by insurers (EIOPA, 2019). The latter does not aim to replace traditional historical and declarative data, but about using both in an attempt to gain new insights and develop new tools of data analysis.

It is more voluminous, so more generous data is available, but also more detailed and even precise. Common to all new types of data is the characteristic that is often used to describe newly accessible information: the granularity. Granularity being the quality of including a lot of small detail (granularity, n. 2013), in the context of information it refers to the level of detail at which data are stored in a database (Harrington, 2016). The new sources of information and the associated increase in details might allow insurers to improve the risk analysis and, as it is sometimes claimed, to predict consumers’ behavior.

Another distinction that is commonly used when describing new data is the distinction between “hot” and “cold” data. These are technical terms related to data storage: cold data is rarely accessed, while hot data is accessed frequently. By extension, these terms are also used to describe data that does not change much, as historical datasets, compared to the data which is changing frequently, such as stock exchange board for example.

In fields such as marketing, cold data describes the information that stays stable over time and can be used later or permanently once collected, such as consumers’ dates of birth. Hot data describes recently collected data that must be rapidly treated and analyzed to provide the best possible use for the commercial goals. For instance, data on online behavior can be used to predict an intention to buy the product or an intention to leave or break the contract. It can be used to target consumer groups or to prevent customer attrition.

It must be noted that we deliberately choose, in this thesis, not to refer to the information becoming available to the insurers as to big data. The reasons for this decision are the following. Our main point of interest is the fact that it becomes currently possible to use more information for risk classification and prevention. Consequently, we do not discuss the particularities of big data, such as high velocity for example (the rate of generation and analysis of big data), and we discuss only briefly the potential issues created by the techniques used to treat it, such as algorithms and machine learning.

In 2016, Financial Conduct Authority (FCA) has issued a statement following their call for inputs on big data in insurance.2 This statement declares that by referring to big data, the authors refer to the practices of using new or expanded datasets, including from unconventional sources, such as social media; to the prac-tices of adopting the technologies required to generate, collect and store these new forms of data; to the practices of using advanced data processing and analytical techniques such as predictive analytics; and to the application of resulting knowl-edge in business decisions and activities (FCA, 2016). In the same spirit, we want to focus in particular on the fact that more information is available today to insurers, and discuss new ways of using it. In the rest of this section, we will describe new types of data available to the insurers, new sources, as well as tools of analysis. We will follow with the examination of the impact that new data has on the sector, both from the perspective of the new nature of the information, and the applications that result from this information availability.

New possibilities that create new companies

New applications can be sorted into three categories depending on the branches of the insurance business to which they are related: automation, distribution, and proposition (Keller et al., 2018). First, it is possible to automate some processes related to the insurance busi-ness, such as underwriting and claims handling. American start-up Lemonade and French startup Shift Technology both use AI to offer innovative insurance products. Lemonade uses AI to simplify its policy offering procedures, tailor the contract of-fered to the needs of the consumer and speed up claims payments. Shift Technology uses AI to help insurers automate their claims assessment by using the automatic validation of claim details and reports by comparison with the policy terms. More-over, Shift Technology also offers an AI-based solution to identify suspicious claims and prevent fraud.

Second, it is possible to introduce new ways of interaction with customers through mobile applications, by means of virtual assistants, or to apply targeted marketing. A French insurer GAN Prévoyance has partnered with a French startup DreamQuark that develops AI-based solutions for the financial and insurance sec-tors. They have developed an algorithm-based product aimed to better tailor mar-keting campaigns for new clients by predicting customer propensity for pensions, retirement or savings insurance products.4 DreamQuark has also partnered with AG2R La Mondiale to create a tool aimed to decrease attrition rates. The solution uses algorithms to detect clients that might presumably decide to leave, which gives the insurer a possibility to prevent the loss of customers. A French mutual insurer MAIF had also developed a tool that uses behavioral data on web surfing to detect the policyholders that are likely to be hesitant about keeping their contract.

Last, technologies allow creating new products and offers, such as peer-to-peer insurance, on-demand insurance, and usage-based insurance. A German insurer Friendsurance uses its digital platform to provide peer-to-peer insurance contracts since 2010. Another German startup, One, is the first fully digital licensed European Insurance Carrier launched in 2018.6 One uses AI and IoT devices to promote the protection and has recently introduced its application OneCoach as a joint venture with Munich Re. The application aims to help policyholders to assess their risk and provides rewards and personalized insurance packages based on their personal lifestyle. It uses the smartphone’s GPS module to collect data on the user’s location and movements and to offer preemptive protection guidance. It also offers real-time short-term insurance contracts that can be purchased instantly for an ongoing trip or for the duration of the journey, which can be launched automatically using the same GPS module. Additionally, the German insurer uses encryption technology to protect personal data and claims to transfer and store anonymously the information on health, movements, or location, as well as to offer full transparency on data processing to the policyholders.

Another French insurance startup Luko, operating in the home and property insurance sector as well as Lemonade, has recently launched a test program for existent policyholders, aiming to introduce additional prevention services based on the IoT devices for risk prevention. The policyholders joining the program can test three connected devices to mitigate the risk of fire damage, water damage, and burglary. The French insurer also offers a premium discount to the policyholders that install a smart alarm system from a partnering company Netatmo.

Apart from life insurance, two big insurance sectors are health and automobile insurance: the former because everybody is exposed to the health risks, and the lat-ter because vehicle insurance is often compulsory. According to the French Insurance Federation (Fédération Française de l’Assurance), the total amount of premiums in health insurance was 24.8 billion euros in 2019, and 22.8 billion euros in automobile insurance the same year, making these branches the second and the third biggest insurance sectors in France. We will continue to discuss the ways in which new data and technologies are integrated into insurance contracts by examining these two sectors in particular.

Automobile insurance and telematics

The biggest sector where new technologies and new data have created new insur-ance products is the automobile insurance sector. The insurance contracts that are tailored based on the usage or the behavior are referred to as Usage-Based Insurance (UBI). This umbrella term applied to car insurance includes the insurance coverage based on the actual usage, such as the insurance coverage based on kilometers driven (Pay-As-You-Drive (PAYD)), or the insurance coverage based on the driving behav-ior estimated from the data collected through the black boxes (Pay-How-You-Drive (PHYD)).

In the case of PHYD insurance, telematics data, which is collected and transmit-ted via GPS, include information such as driving speed, harsh braking, acceleration, cornering, or time of the day the journey is made. The insurers often collaborate with third-party services that provide them with the results of data analysis. In particular, those firms calculate “scores” based on the indicators of driving behav-ior collected through telematics. Those scores are then used by insurers to offer discounts to the policyholders showing good driving behavior.

The UBI contracts have been introduced to the market for some time.14 Never-theless, the rate of personal telematics insurance policies is growing, and new strate-gic uses of telematics data continue to develop. For instance, an American insurer Metromile offering a distance-based PAYD insurance has recently made a strategic move by starting to offer a free insurance quote based on the telematics data since October 2020.15 Users can download a smartphone application that tracks their mileage and other driving data during two following weeks. Then it calculates a free estimation for their potential insurance premium and the coverage suitable for their needs. This offer is designed to help potential customers to better understand the benefits of UBI and attract new clients interested in such individualized insurance contracts, given that such an option is not commonly available to try for free. Other big American auto insurers offering UBI programs, such as Progressive and Allstate, provide usage-based premiums only to the actual policyholders on the first purchase of coverage. Another example of strategic innovation in telematics insurance is given by the UK insurer Cuvva, which offers PAYD insurance coverage since 2016. Cuvva has recently launched a new flexible pay-monthly motor insurance coverage which can be canceled at any time. The largest markets for telematics insurance are the US, Canada, Italy, and the UK. In North America, the telematics market is represented by such big insurance companies as Progressive, Allstate, Liberty Mutual, Nationwide, and State Farm in the US, as well as Intact Financial Corporation and Desjardins in Canada. In Europe, more than 50% of telematics insurance contracts are offered by the Italian insurers UnipolSai and Generali.17 Italy represents one of the biggest European markets for telematics insurance because the Italian legislation recommends the installation of telematics devices to all car insurance providers and the use of telem-atics data to set premiums since 2017. The Italian Insurance Association estimates that telematics boxes have been installed in over 2 million of cars in Italy (OECD, 2017).

The UK software company The Floow provides automobile insurers, car-makers, and fleet operators with telematics solutions. The company has recently launched a smartphone-based crash detection service.18 It is based on a machine-learning algorithm that uses data from crash tests to analyze it and compare it to the real-life claims database from multiple insurance providers. The algorithm is then used to assess the factors and conditions of each journey in real-time and evaluate if a high severity incident has taken place. It is also able to issue a crash report based on crash data, allowing for quick intervention by roadside assistance and quick claim handling. The company has also developed the first UK telematics insurance coverage based only on a smartphone application, in collaboration with Direct Line Group, one of the main UK insurers offering UBI contracts.

The implications of new data usage for the insurance sector

In the present section, we first discuss more general implications of data availability, such as new actors penetrating the market and the ways in which the accessibility of information affects the information asymmetry, characteristic of the insurance market. We further proceed with a discussion on the implications concerning risk classification and risk prevention.

Market structure and the information asymmetry are challenged

As it appears from the discussion provided above, new actors increasingly make concurrence to the incumbent insurers, for two reasons in particular. The access to technologies and data in general, even related to the activities which are not necessarily linked to the insured risks, provides a big advantage to the companies operating in the digital sphere. Consequently, the companies that have access to data due to their specialization in the technological sector start to exert insurance activities as well.

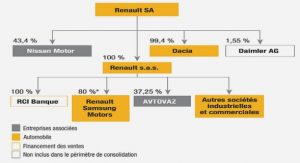

At the same time, it appears less crucial than before to have an established port-folio of policyholders and access to long-term historical data on their risk experience. The advantage of size does not seem to be the factor preventing start-ups from en-gaging in the insurance activity, in light of the technological capacities allowing them to compete with the incumbent insurance firms. Therefore, we can distinguish two types of new actors that start to acquire an important share of the market. First, big tech companies, such as Apple, Amazon and Google, are developing their own insurance products. Verily Life Science, a subsidiary firm of Google’s parent company Alphabet, is launching this year its insurance company Coefficient, which is reinsured by Swiss Re.

Second, insurtech startups have an increasingly bigger weight in the market. The value of capital invested in insurtech companies worldwide was 13.4 billion U.S. dollars in 2019.22 Those startups are represented by the managing general agents, which are companies associated with the licensed insurers, and by the full-stack insurtechs which are independent companies that have their own license to sell insurance contracts.23 Such independent insurtech companies start to operate in the market, despite the fact that the procedure to receive an insurance license can be a barrier. Besides, as we mentioned in the introduction, information asymmetry is particu-larly prevalent in the insurance market. From the theoretical point of view, informa-tion asymmetry issues reflect a market inefficiency. On the practical side, insurers employ substantial resources to assess the risks and verify information provided by policyholders (Keller et al., 2018).

Non-monotonicity of the ruin probability in case of binary distributed claims

When risks are binary distributed, the number of individual payments (premiums) required to cover one loss is equal to nˆ = {n | θnπh + (1 − θ)nπl = L} . Hence, the minimum number of policyholders required to cover one loss is equal to n = min n ∈ N | θnπh +(1−θ)nπl ≥ L ,. In other words, if nˆ is the number of individual payments required to cover exactly one loss, then n is the number of policyholders required to provide the necessary amount of premiums: n = dnˆe . It is therefore the minimum pool size required to achieve the capacity to cover one loss.

The minimum pool size n required to cover one loss depends on the pool compo-sition: multiple combinations of high and low risks provide the necessary amount of the risk-bearing capital. For instance, for a given number of high-risk policyholders nh, the minimum pool size n is given by n such that n = &L − nh (πh − πl)’ , πl and the premium quantity required to cover exactly one loss is nˆ = nh + nˆl , with nˆl such that nhπh + nˆlπl = L . Furthermore, since n denote the minimum required number of policyholders, we must have nh, nl ∈ N .

A low-risk agent has a lower loss probability than a high-risk agent. Yet, if the loading is multiplicative, she also contributes less to the common reserves. In this case, a decrease in risk-bearing capital generated by a diminished proportion of high-risk policyholders θ cannot be balanced by an increased proportion of low-risk policyholders (1 − θ), as it appears in the expression for collected premiums: θnπh + (1 − θ)nπl . Hence, in this case, there is no direct substitution between two risk types. Furthermore, insurance funds represented by premiums serve their purpose when losses can actually be covered. Since it requires a precise number and combination of policyholders to cover one loss, an additional policyholder does not necessarily improve the coverage capacity.

Table of contents :

1 The insurance sector in the new digital era

1.1 Introduction

1.2 New data and new tools originating from digital technologies

1.2.1 New kinds of available data

1.2.2 New sources of information

1.2.3 New tools of data analysis

1.3 New data shapes the insurance practice and the insurance sector

1.3.1 New possibilities that create new companies

1.3.2 Health insurance and personal data

1.3.3 Automobile insurance and telematics

1.4 The implications of new data usage for the insurance sector

1.4.1 Market structure and the information asymmetry are challenged

1.4.2 Individualization, personalization and risk classification

1.4.3 Behavioral data, new contracts and risk prevention

1.5 Conclusion

2 Risk pooling and ruin probability, or why high risks are not bad

2.1 Introduction

2.2 Related literature

2.2.1 The policyholder’s point of view

2.2.2 The insurer’s point of view

2.2.3 The regulatory approach

2.3 Probability of insolvency and high-risk agents

2.3.1 Binary distribution

2.3.2 Normal distribution

2.4 Discussion

2.5 Conclusion

Appendix A

A.1 Non-monotonicity of the ruin probability in case of binary distributed claims

3 Mutual or stock insurance: solidarity when insolvency matters

3.1 Introduction

3.2 Related literature

3.2.1 The impact of insurer’s insolvency

3.2.2 Stock and mutual insurance considered together

3.2.3 Endogenous insolvency with both stock and mutual insurers .

3.3 The model with two types of insurers and endogenous insolvency

3.3.1 Stock insurer: individualized premiums and the risk loading .

3.3.2 Mutual insurer: average premiums and ex post adjustment

3.4 The choice of the insurer’s type

3.5 Discussion

3.6 Conclusion

Appendix B

B.1 Proof of Proposition 3.1

B.2 Proof of Corollary 3.1

B.3 Proof of Proposition 3.2

4 Behavioral contract or bonus-malus contract for improving prevention: an experimental approach

4.1 Introduction

4.2 Related literature

4.2.1 Prevention effort and self-protection

4.2.2 Bonus-malus contract and experience-rating systems

4.3 Prevention decisions with two contract types

4.3.1 The model of prevention with two contract types

4.3.2 Optimal prevention level

4.3.3 Theoretical predictions and experimental treatments

4.4 Experimental design

4.4.1 Individual choice of prevention effort and contract type

4.4.2 Elicitation of prudence and risk aversion

4.4.3 Monetary incentives

4.5 Results

4.5.1 Average prevention effort in the first and second parts of the game

4.5.2 Choosing a contract

4.5.3 Econometric analysis

4.6 Conclusion

Appendix C

C.1 Optimal prevention level

C.2 Experimental instructions in French

C.3 Non-parametric analysis: results of additional Mann-Whitney tests .

General conclusion

Conclusion générale

Bibliography