Get Complete Project Material File(s) Now! »

Identifying obstacles to a decarbonized society

An ideal decarbonization program would therefore contain different measures targeting as many specific problems, structured around a carbon tax with dividend to align the choices of the whole society with the climate objective. But a key question remains : are people ready to shake up their lifestyles (taking little air travel, eating little meat, etc.) ? It is by no means obvious that a majority accepts these measures, even though they were designed to financially compensate the greatest number. This requires that most voters understand the climate issues, support the emission reduction targets, agree with the justifications for the proposed measures, and trust the government to implement them. These conditions are not obvious, especially since the effects of different measures are uncertain for anyone : for example, who can predict how the value of their house will be affected by decarbonization and the new land use planning it implies ? Loss aversion encourages the inaction of the status quo in such situations of uncertainty (Stiglitz, 2019).

In addition to this obstacle of decarbonization due to political acceptability, a potential physical limit drew my attention when I thought about these issues. Would an energy system based solely on renewables be viable and efficient ? While plans for transforming the energy system to all-renewable have been proposed, they neglect the energy cost of building the energy system itself. Or rather, they consider that a wind turbine or solar panel will require as much energy to be manufactured in a carbon-free world as it does today. However, it appears that the manufacture of wind turbines or solar panels requires more energy than that of thermal power plants (Weißbach et al., 2013). Therefore, if wind turbines and solar panels are manufactured using electricity from renewable sources rather than fossil fuels, the energy required (throughout the supply chain) for their manufacture increases. It is therefore crucial to know whether or not this effect compromises the efficiency of renewables in providing energy.

Finally, another obstacle to a decarbonized civilization is that it still relies on finite resources : metals. Indeed, no industry would be possible without metals, and this is particularly true for renewable energy production, which is very metal-intensive (Hertwich et al., 2015). However, when we consider the phenomenal energy that would be required to recover at the end of their life all the metal that made up our products (some of which has been dissipated into the environment and some of which is diluted in alloys), it is plausible that this energy exceeds the energy we can deliver by building power plants from this metal. This means that a strictly circular industrial metabolism is impossible, and that recycling will necessarily be partial. Admittedly, in practice, recyclability and mining resources may be high enough to ensure that humanity will not run out of metal for millions of years, but there is no guarantee of this. On the contrary, some experts predict a peak in copper mining by the middle of the 21st century and predict depletion of the resource within two centuries (Gordon et al., 2006; Henckens et al., 2014; Kerr, 2014; Sverdrup et al., 2014). While these alarmist predictions use an unduly narrow definition of what constitutes a copper resource, even the more optimistic estimates suggest that the resource will be depleted within a few thousand years (Kesler & Wilkinson, 2008).

My thesis work consisted in analyzing these three obstacles to the emergence of a sustainable decarbonized society.

Estimation of Current and Future EROIs Using THEMIS

Different notions of EROIs have been used in the literature, and some papers clarify them all (e.g. Brandt & Dale, 2011; Murphy et al., 2011). The most relevant notion for this research is defined by Brandt & Dale (2011) as the Gross Energy Ratio (GER). The GER measures the ratio of energy delivered over energy embodied in inputs net of the energy of the fuels transformed in the process (to avoid double-accounting). Thus, for example, the denominator of the GER does not take into account the energy provided by gas in a gas powered plant. The term “gross” is used because all energy output is taken into account ; on the contrary Net Energy Ratios subtract from the numerator all “self-use” output that is used in the pathway of production of the technology. 5 A related indicator that is sometimes used to compute EROI (as it is already included in many input-output databases) is the Cumulated Energy Demand (CED). I do not use it because Arvesen & Hertwich (2015) have shown that it is erroneous to use the CED directly for EROI computations, without making adjustments.

In most cases, EROIs (or energy ratios) are defined using quantities of primary energy. However, I adopt a different approach in this paper, and use only secondary energies in my computations. Indeed, as Arvesen & Hertwich (2015) put it, “EROI does not need to measure primary energy per se ; the crucial point is to measure energy diverted from society in a unit of equivalence”. Also, the choice of secondary energy carriers is consistent with an energy system relying on renewable electricity, while for such systems the definition of primary energy is not harmonized and this can lead to inconsistencies : Frischknecht et al. (2015) spot for example a factor 6 between the cumu-lative (primary) energy demand for solar photovoltaic computed according to different methods. Although the sectors bringing energy are not the same in the two approaches (the primary ap-proach uses crude oil when the secondary approach uses gasoline, for example), both approaches are equally valid.

Implications of a Decreasing EROI on Prices and GDP

The forecast of declining EROIs made in the previous section calls for an assessment of its economic implications. The main channel through which a decrease in EROI could affect the economy is arguably a rise in energy price (and correlatively, in energy expenditures). In this section, I review the literature on the relation between EROI and the price of energy, estimate it empirically, and extend a result from Herendeen (2015) to characterize this relation. As in previous work, an inverse relation is documented empirically. Yet, theoretical analysis shows that EROI and price might decrease together. This theoretical result tempers the view that a decreasing EROI necessarily leads to a contraction of GDP.

Empirical Relation Between EROI and Price

Using US data on oil and EROI from Cleveland (2005), Heun & de Wit (2012) regress pt on the EROI. 9 They obtain a good fit even in their simplest regression (R2 = 0:8), and find poil = 0 EROIoil1:4.

This result is interesting, and documents a negative relationship between price and EROI, which is close to an inverse one. As the authors do not regress price on the inverse of EROI, one cannot compare whether an inverse specification would provide as good a fit as a log-log one. To undertake this comparison, I run these two regressions using all estimates of EROI computed using THEMIS, one for each combination of scenario, year, region and sector. To obtain the price corresponding to each EROI, which I take before taxes and subsidies on production ; I assemble from the columns compensation of employees and operating surplus of the characterization matrix of THEMIS a row vector v of value-added per unit of each sector. Indeed, the vector of prices excluding tax p can be seen as emerging from value-added according to p = v (I A) 1 ES (4.3). because the price of energy in sector s, ps, is the sum of the value-added of inputs embodied in s : v (I A) 1 1s, divided by the energy supplied by one unit of s : EsS. To the extent that the physical constituents and processes of a given technology will not change in an unexpected way, and as THEMIS models technical progress but not behaviors nor general equilibrium effects, prices forecast using the above formula might not be as reliable as EROI estimates. For this reason, I report only the global average electricity prices of the main scenarios (see Table 4.3), but I do not detail the substantial variations between regions or sectors.

Table of contents :

I Is renewable electricity sustainable ? Evolution of EROIs until 2050 1

1 Introduction

2 The EROI of a Technology Is Not Intrinsic

3 Estimation of Current and Future EROIs Using THEMIS

4 Implications of a Decreasing EROI on Prices and GDP

5 Concluding Remarks

Appendix

A Updating a Matrix A To a New Given Mix

B Example of Non-Decreasing Relation Between EROI and Price

C Complementary Results

1. Ecological Economics, 2019.

D Proof of Proposition 4.1

II How recyclability affects the optimal timing of the transition 2

1 Introduction

2 The model

3 Optimal energy production with infinite horizon

4 Extensions in a two-period model

5 Conclusion

Appendix

A Solutions of the infinite horizon

B Optimality of the solutions

C Other Appendices

D Karush-Kuhn-Tucker in infinite horizon 3

IIIYellow Vests, pessimistic beliefs, and carbon tax aversion 4

1 Introduction

2 Context, survey, and data

3 Pessimistic beliefs

4 How attitudes shape beliefs

5 How beliefs determine attitudes

6 Conclusion

Appendix

A Raw data

B Notations

C The use of official household survey data

D Persistence of beliefs in self-interest

E Additional specifications

F Control variables

G Questionnaire

H Support rates for Tax & Dividend policies

I Relation between support and belief in progressivity

J Willingness to pay

K Ensuring data quality

IV French attitudes on climate change, carbon taxation and other climate policies

1 Introduction

2 The survey

3 Perceptions and Attitudes over Climate Change

4 Attitudes over Carbon Tax and Dividend

5 Attitudes over Other Policies

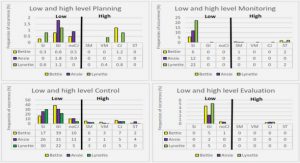

6 Determinants of Attitudes

7 Conclusion

Appendix

A Sources on GHG emissions

B Details on main regressions

C Questionnaire

D Additional results on attitudes over climate change

E Test different wording for winners and losers

F Who are the Yellow Vests

G Additional specifications for determinants of attitudes

H Construction of the knowledge index

I Logit regressions for determinants

J Robustness for the absence of cultural cognition effect

Bibliographie