Get Complete Project Material File(s) Now! »

Concentration of ownership at country level

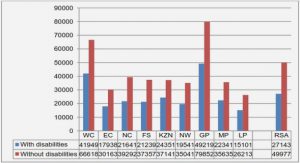

Concentration of ownership at macro level or across a country is an issue that has been of interest, as seen in Table 2.3. Faccio and Lang (2002:391), in their study of ownership of Western European firms, found Italy to have the largest number of firms controlled by a single family at 1.46 firms. Switzerland had the lowest number of firms per single controlling shareholder at 1.10 firms. Claessens et al. (2000:108), in their study of ownership of East Asian firms, found the following average number of firms per family, the percentage of total value of listed corporate assets controlled by the top 15 families and the percentage of gross domestic product associated with the top 15 families.

Conflict between equity investors and debt

Conflict between equity investors and debt only arises if there is risk that there is a default, in which case equity investors can make a gain, to the lenders’ detriment. Due to the residual nature of equity investors’ claims, equity investors stand to gain if the value of debt falls. Where managers act in the shareholders’ interests, they transfer firm value from the creditors to shareholders if there is a high probability of default. Such transfers could take several forms. According to Jensen and Meckling (1976:335), one way is for managers to take on higher risk by making investments in higher risk assets or adopt riskier operating strategies. Creditors take the downside risk while shareholders get the upside risk.

Momentum theory of capital structure

Momentum profitability or earnings momentum, a trading strategy of buying past winners and selling past losers has been extended to other areas of finance including capital structure, and can be traced to Jegadeesh and Titman (1993:67). The phenomenon violates the weak form of market efficiency and has been considered an anomaly (Fama & French 1996:55), while Schwert (2003:941) expected it to be shortlived. Jegadeesh and Titman (2001:699) confirmed its persistence in practice.Two strands of research emanated from attempts to explain momentum profitability.

Free cash flow theory and capital structure

The over-investment problem is considered a unique case of agency theory and can be explained as follows: managers have an impetus to maximise their own well-being (by giving themselves excessive perquisites, job security and exorbitant salaries) at the expense of shareholders; they effectively do this by making sure that corporate governance mechanisms, whether external or internal, do not regulate their behaviour; the prestige of being a manager of a big firm is considered to be a benefit which prompts managers to invest in projects that do not necessarily increase shareholders’ wealth.

TYPES OF OWNERSHIPS AND CAPITAL STRUCTURE

In Section 2.2, the extent to which a firm’s ownership was concentrated or diffused and how such ownership concentration could be related to capital structure were discussed.

Section 2.3 discussed capital structure theories. The preceding sections provided more insight into how the extent to which a firm was owned could be related to its capital structure. This section reviews the literature on different types of ownerships and how they relate to capital structure. The intention is to examine whether the extant literature provides consensus on how the identity of shareholders affects the leverage of a firm.

The main categories or ownership identities reviewed include management, institutional investors, foreign and government.

Foreign ownership and capital structure

Under the first part of the main objective discussed in Chapter 1, namely investigating whether ownership affects the capital structure of a firm, it is important to consider whether ownership is indigenous or foreign. This discussion forms part of the literature which deals with the importance of types of owners and their effect on capital structure.

The purpose of this section is to review the literature on the effects of foreign ownership on capital structure, because the literature identifies foreign investors as having a bearing on capital structure. An understanding of the relationship between these variables helps to understand the research problem and enables the formulation of the relevant hypotheses to be investigated by the study.

ABSTRACT

DECLARATION AND COPYRIGHT

DEDICATION

ACKNOWLEDGEMENTS

LIST OF ABBREVIATIONS

CHAPTER 1

INTRODUCTION

1.1 BACKGROUND

1.2 RATIONALE FOR THE STUDY

1.3 RESEARCH QUESTIONS

1.4 RESEARCH CONTRIBUTION

1.5 STRUCTURE OF THE RESEARCH

CHAPTER 2

LITERATURE REVIEW OF THE RELATIONSHIP BETWEEN OWNERSHIP AND

CAPITAL STRUCTURE

2.1 INTRODUCTION

2.2 INTRODUCTION TO CONCENTRATION OF OWNERSHIP

2.2.1 Concentration of ownership and capital structure

2.2.2 Concentration of ownership at country level

2.3 CAPITAL STRUCTURE THEORIES

2.3.1 Modigliani and Miller’s irrelevance theory

2.3.2 Trade-off theory

2.3.3 Asymmetric information theories

2.3.4 Product/input interactions theory

2.3.5 Agency costs and capital structure

2.3.6 Momentum theory of capital structure

2.3.7 Free cash flow theory and capital structure

2.4 TYPES OF OWNERSHIPS AND CAPITAL STRUCTURE

2.4.1 Managerial/ family ownership and capital structure

2.4.2 Institutional ownership and capital structure

2.4.3 Foreign ownership and capital structure

2.4.4 State ownership and firm capital structure

2.4.5 Black ownership and capital structure

2.4.6 Public Investment Corporation ownership and capital structure

2.4.7 Company ownership and capital structure

2.5 MEASURES OF CAPITAL STRUCTURE AND OWNERSHIP

2.5.1 Control variables

2.5.2 Measures of capital structure

2.6 EMERGING HYPOTHESES

2.7 CONCLUSION

CHAPTER 3

LITERATURE REVIEW OF THE RELATIONSHIP BETWEEN OWNERSHIP AND

FIRM PERFORMANCE

3.1 INTRODUCTION

3.2 EFFECTS OF OWNERSHIP CONCENTRATION ON FIRM PERFORMANCE

3.3 TYPES OF OWNERSHIPS AND CORPORATE PERFORMANCE

3.3.1 Managerial ownership and corporate performance

3.3.2 Family ownership and corporate performance

3.3.3 Dual-class shares and corporate performance

3.3.4 State ownership and firm performance

3.3.5 Institutional ownership and corporate performance

3.3.6 Foreign ownership and corporate performance

3.3.7 Black ownership and corporate performance

3.3.8 Public Investment Corporation ownership and corporate performance

3.3.9 Corporate ownership and firm performance

3.4 MEASURES OF FIRM PERFORMANCE AND CONTROL VARIABLES

3.4.1 Performance variables

3.4.2 Control variables

3.5 EMERGING HYPOTHESES

3.6 CONCLUSION

CHAPTER 4

RESEARCH METHODOLOGY

4.1 INTRODUCTION

4.2 RESEARCH PARADIGM AND PHILOSOPHY

4.3 DATA AND SAMPLE

4.4 VARIABLES OF THE STUDY

4.4.1 Ownership and capital structure

4.4.2 Ownership and corporate performance

4.5 ANALYSIS OF DATA

4.6 EMPIRICAL MODELS

4.6.1 Ownership and capital structure models

4.6.2 Ownership and corporate performance models

4.7 CONCLUSION

Bibliography