Get Complete Project Material File(s) Now! »

Pharmaceutical sector

Together with the motor vehicle’s industry and the telecom sector, the pharmaceutical in-dustry is one of Sweden’s largest export sectors. The pharmaceutical industry stands for almost 6% of Sweden’s total exports. In Figure 2.1 one can see the development of Sweden’s pharmaceutical export as a share of total exports from Swe-den over time from 1997-2003. As can be seen, the pharmaceutical in-dustry increases its share of total export over time, becoming more important for Sweden’s exports, starting with approximately 3.6% of total export and increases to more than 6% in 2003. (SCBk)

While the pharmaceutical industry increased their share of Swedish exports by approxi-mately 2.5 percentage points, two other important export groups for Sweden, the telecom sector and the motor vehicles’ industry, were not growing at the same rates. In fact, the telecom sector decreased their share significantly, while the motor vehicle’s sector increased their share of the total exports with less than one percentage point. (SCBd)

Sweden has had a positive balance of trade in the pharmaceutical in-dustry for a long time now. The imports are not increasing as fast as the exports in this sector, therefore the balance of trade increases over time. In 1997, the exports exceeded the imports by 14.7 million SEK. The balance of trade in pharmaceu-tical products increased to 35.1 mil-lion SEK in 2003. Figure 2.2 shows how the pharmaceutical imports have developed over time as a share of Swedish total imports.

This import share has been stable over time, fluctuating just a little bit below 2%. (SCBe; LIF(b)) Sweden’s share of total exports from the OECD-countries has decreased slightly from 1997 to 2003. In 1997, Sweden exported 4.6% of the total exports of pharmaceutical products of the OECD countries. In Figure 2.3 below one can see how the share has decreased over time. The countries that export the most in the world are Belgium (14.3%), Germany (12.5%) and UK (10.7%). Sweden is the tenth largest exporter of pharmaceutical products. All the top-ten countries are among the richest countries in the world. Among these are nine European countries and the USA. Sweden is said to have a Revealed Comparative Advantage (RCA) of exports of pharmaceutical products compared to the OECD coun-tries. In 1997, the RCA for Sweden’s exports of pharmaceutical product was 2.38. As Sweden’s share of pharmaceutical export decreased, so did the RCA as well. In 2003, the RCA for Swe-den in pharmaceutical products was 1.93, which means that Swe-den still has RCA for pharmaceu-tical products. (OECD, Statistics, 2007)

The pharmaceutical industry in Sweden is important also because it employs many people, both direct and indirect. Indirect employment can for instance be due to the transport of pharmaceutical products and lawyers the pharmaceutical companies hire. (SCBj)

Research and Development in the Pharmaceutical Indus-try

The total amount of person-years2 in R&D activities in the pharmaceutical companies in Sweden was 5 053 person-years in 2003. The number of person-year decreased slightly since 1997 when 5 112 person-year was made in the pharmaceutical companies. This figure means that around 10% of the total amount of person-years in R&D in Sweden is done by the pharmaceutical companies. (SCBj)

In the pharmaceutical industry, it is basically two group of investors and two groups who execute the R&D activities. The companies both finance and execute R&D activities. The other investor is the public sector. In 2003, the companies contributed with 74% of the to-tal funding. Most of the money was spent on developing new products and second most in improving already existing products. Together with the companies, the Universities also execute R&D. In 2003, the Universities executed 22% of the total R&D. (SCBb; SCBc; SCBg)

In the year 2000, the European Union (EU) set up the Lisbon Strategy which says that each country in the union should devote at least 3% of their GDP for R&D activities in 2010 and that the companies should contribute with 2% of the 3%. Sweden spent 4% of GDP on R&D in 2003, so Sweden already fulfils the target level. (European Commission, In-crease and improve investment in Research and Development, 2007; SCBh)

Most of the worlds R&D in the pharmaceutical sector take place in the USA, while only 16.67% takes place inside the EU. Studies have shown that it costs approximately 8500 mil-lion SEK to develop one new medicine, and that only 30% of the new medicines are so successful in the market, so it can cover its own R&D costs. Therefore exports are ex-tremely important for a relatively small country like Sweden. Most of the new products that enter the market are developed in the USA, while only 40% is discovered in Europe. 30 years ago the figure was about the opposite. (European Federation of Pharmaceutical In-dustries and Associations (EFPIA(a))

Products and Institutional framework

The pharmaceutical industry is somewhat different compared to other industries. This is mainly due to the time it takes to develop a new product and that a new medicine has to be approved by either “Läkemedelsmyndigheten” or the European Agency for the Evaluation of Medicinal Products (EMEA) before it can be sold in the market. In USA it is the Food and Drug Administration (FDA) who decides upon which of the new drugs will be ap-proved. This is because the new medicine has to go through several years of testing to minimize its side-effects and control the effect of the new drug. Due to the complexity of new products, only one out of 5 000- 10 000 molecules tested will be approved by the gov-erning institution so it can be sold in the market. The manufacturer must prove that the medicine is safe and fulfils its purpose. Every fifth year, the decisive authority will review its approval of the medicine. A reason for retrieve the approval can be that new previously undiscovered side-effects have been discerned, or that a new and better medicine has en-tered the market. (EFPIA(a); LIF(a))

A basic patent stretches over 20 years. This means that the average effective patent last only 10-12 years, so the pharmaceutical companies must develop new products in a 10-year cycle. (EFPIA, Did you know that?, 2007) The medicine can receive a so-called Supple-mentary Protection Certificate which means that the basic patent is extended for a maxi-mum of five years.3 (EFPIA(b))

Developing a new medicine takes several years and extensive research and testing is manda-tory. Once a new possible medicine is identified, the preclinical testing can begin. The in-tention with the preclinical testing is to identify any damage the new medicine can have be-fore human tests begin. (Pharmaceutical Research and Manufactures of America, Research and Development, 2007)

The second step starts with an application to the decisive authority where the results of the preclinical tests are presented and how the further studies will continue. If the application is approved by the authorities the clinical trials can start. The clinical trials involve testing the new medicine on both healthy people and people carrying the disease the medicine is meant to cure. When the clinical testing is finished, a new application has to be approved by the decisive authority, which covers all the information of all the studies. If the authori-ties once again approve the application, the medicine becomes available for patients. The companies often continue with their research, in order to discover side-effects that appear in the long run. (Pharmaceutical Research and Manufactures of America, Research and Development, 2007)

In the pharmaceutical industry, mergers and acquisitions are not unusual. The two most well-known Swedish companies Astra and Pharmacia have also engaged in this kind of ac-tivities. Astra merged with the British Zeneca in 1999 to become AstraZeneca. Now, the head office is located in London, although the head office for the R&D unit is located in Sweden. AstraZeneca has production in several different countries around the world. However, some of their most important production factories are still located in Sweden. (AstraZeneca, Verksamheten i Sverige, 2007; LIF(b))

Pharmacia & Upjohn is a merger of the two companies Pharmacia and Upjohn in 1995. In 2000, Pharmacia & Upjohn merged with Searle and now it was just called Pharmacia. Three years later, it was bought by the USA Company Pfizer, which is the world-leading pharma-ceutical company today. (Pfizer, Pfizer växer, 2007; LIF(b))

Trade in R&D intensive goods – a Theoretical Framework

The aim of this Chapter is to give the reader a presentation of the economic theories nec-essary to analyse and explain Sweden’s export of pharmaceutical products. The Chapter is divided into three sections. The first section gives a short review of trade theories before dealing with the Modern Trade Theory. The second section of this Chapter deals with the Monopolistic Competition model, while the last section presents the Product Life Cycle Theory.

From Basic Trade Models to the Modern Trade Theory

The detection that a country can benefit from trade was made by Adam Smith (1776). Then, among others, Leontief, Posner and Vernon, have developed and found that a coun-try do benefit from trade. These researches have resulted in two major theories, David Ri-cardo’s (1817) theory of comparative advantage and the factor abundance model. 4 The theory of comparative advantage is essential to understand the modern theory of interna-tional trade. What Ricardo said was that even if one country has a lower relative cost in producing both goods, trade is beneficial to both countries. What matters is the opportu-nity cost of producing of good as a measure of how many of the other good that has to be given up. (Bowen, Hollander, Viaene, 2001) The factor abundance model assumes that the two countries are identical, except in their factor endowments. The countries will then pro-duce the good in which they are relative abundant of, so the capital abundant country will export the capital intensive good and the labour abundant country will export the labour intensive good. R&D intensive products requires a high-skilled workforce, therefore the country that are relatively abundant in educated labour will produce the R&D intensive products. (Bowen et al. 2001)

The theories based on comparative advantage have received critique because the empirical research indicates that much of the world trade actually is between countries with similar factor endowments and is between similar products. The modern trade theory was devel-oped because the models based on comparative advantage were not able to explain this trade, known as intra-industry trade. (Krugman, 1981) To measure the extent of intra-industry trade between two countries, the following equation has been created; I = 1 – (∑|Xk + Mk|) / [∑ (Xk + Mk)] where X and M is the countries export and import in industry k. If there is trade balance, this index will be equal to 1, and if there is complete specialization, the index will be equal to 0. (Krugman, 1981)

Further, a measure to determine how similar the two countries are according to their re-spective factor endowments has also been constructed. This can be seen in Figure 3.1. The two countries will be identical except that the relative size of their labour forces will be dif-ferent. (Krugman, 1981)

The O and O* origins represent home and foreign endowments respectively. The diagonal line between O and O* represents the situation when the factor proportions are equal in the two countries. The downward-sloping diagonal line on the other hand represents eco-nomic size, which are equal for the two countries along that line. The z-variable decides where on the line one will be, from the corner of the Edgeworth box to the centre of it. (Krugman, 1981)

Krugman assumes that there is no transportation costs and that the symmetry of the model assures that the wage rate will be equal in both industries and in both countries, hence w1 = w1* = w2 = w2*. He also assumes tastes and technology to be similar in the two countries. The individual firms are profit maximizing and because Krugman assumes free entry and exit of firms, all firms will earn zero profits in the long run. This will determine the size of the firm, which will be the same in both industries in both countries, due to the assumed symmetry. (Krugman, 1981)

Further, the condition of full employment in both industries and both countries will con-clude how many firms that will produce. The firms will never produce exactly the same product. This is because the firms can at no cost differentiate their products. Krugman ar-gues that this will lead to an equalization of factor prices. Moreover, Krugman declares that everyone will spend an equal amount on both products within an industry and allocate equal shares of expenditure to both industries. (Krugman, 1981)

The income, Y, is assumed to be equal in the two countries as well. This means that the following equations will be true;

X1 = ½ Y * [(2 – z) / 2]

X2 = ½ Y * (z/2)

M1 = ½ Y * (z/2)

M2 = ½ Y * [(2 – z) / 2]

Where X1 is the countries export of commodities produced in industry 1 and X2 is the countries export of commodities produced in industry 2. The M stands for import of the respective industry. (Krugman, 1981)

This means that the home country will export X1 + X2 = ½ Y to the foreign country. The foreign country will import M1 + M2 = ½ Y from the home country. The consumers in both countries will gain because of the “love of variety” effect. They now have more varie-ties to choose from. (Krugman, 1981)

Table of contents :

1 Introduction

2 Background

2.1 Pharmaceutical sector

2.2 Research and Development in the Pharmaceutical Industry

2.3 Products and Institutional framework

3 Trade in R&D intensive goods – a Theoretical Framework

3.1 From Basic Trade Models to the Modern Trade Theory

3.2 Monopolistic competition

3.3 Product Life Cycle theory

3.4 Summary: Reasons for trade in R&D intensive products

4 Empirical Analysis

4.1 The Gravity Equation

4.2 Variables

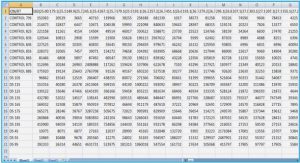

4.3 Data

4.4 Export per product category

4.5 Method

4.6 Results and Analysis

5 Conclusion and suggestions for further research

References

Internet Source

Appendix 1

Appendix 2